In the complex real estate industry, proper accounting tracking is vital for success. Real estate professionals need to meticulously record all financial activities, monitor various costs, and make informed decisions to ensure tax conformity and stability. Digital accounting software streamlines processes, while regular reviews enhance transparency. Analyzing financial data drives strategic decision-making, uncovering patterns and opportunities for real estate ventures' sustainability.

Maintaining meticulous tracking is paramount for real estate professionals to ensure accurate accounting. This article guides you through the essential practices tailored to the unique demands of the real estate sector. We’ll explore fundamental accounting tracking concepts specific to real estate, offering insights on implementing robust recording systems. Additionally, we’ll emphasize the significance of regular financial data reviews, providing valuable tools to extract critical business insights and optimize performance in today’s competitive market.

Understand Accounting Tracking Basics in Real Estate

In the world of real estate, maintaining proper tracking for accounting is paramount. Unlike other industries, real estate transactions are often complex, involving various types of properties, buyers, sellers, and financing options. Therefore, a solid understanding of accounting tracking basics is essential. This includes meticulous record-keeping of all financial dealings, from initial property acquisitions to sales, rentals, and investments.

Real estate professionals need to track not just revenue and expenses but also depreciation, property taxes, insurance, maintenance costs, and various other expenses unique to the sector. Accurate accounting tracking enables better decision-making, facilitates tax compliance, and ensures financial health. It’s a dynamic process that requires staying current with industry regulations and best practices in order to navigate the complex financial landscape of real estate effectively.

Implement Effective Recording Systems for Accuracy

In the realm of Real Estate, maintaining accurate financial records is paramount. Implement effective recording systems that capture every transaction meticulously. Digital accounting software can streamline this process, ensuring data integrity and accessibility. By digitizing records, you can effortlessly track income from property sales, rental payments, and expenses related to maintenance and management.

Regularly reviewing and updating these systems are key. This allows for immediate identification of any discrepancies or anomalies. Such proactive measures foster transparency and trust, which is essential when dealing with significant financial transactions in the Real Estate sector.

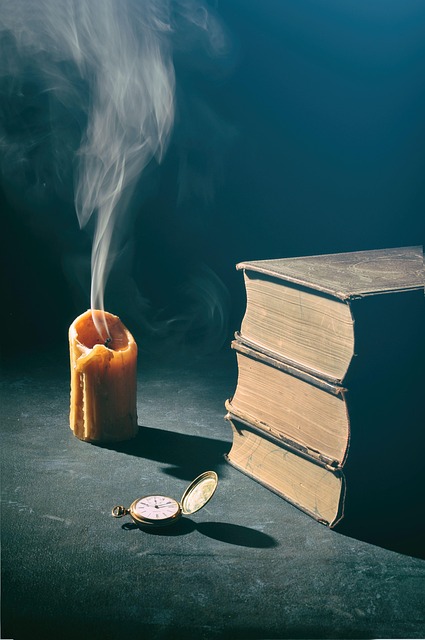

Regularly Review and Analyze Financial Data for Insights

Regular review and analysis of financial data is essential in the dynamic landscape of real estate. By continuously monitoring key metrics, property managers and investors can uncover valuable insights that drive strategic decision-making. This involves scrutinizing financial statements, cash flow trends, and performance indicators to identify patterns, opportunities, and potential red flags.

For instance, a regular review might reveal unexpected fluctuations in rental income or rising operational costs. These observations could prompt further investigations into market changes, tenant behavior, or the effectiveness of cost-saving measures. Such proactive analysis allows for timely adjustments, ensuring the financial health and sustainability of real estate ventures.